BarclaysTalk

MOBILE BANKING APPLICATION

DURATION

6 Weeks

Jan — Feb 2020

TEAM

Kiana Hong

Victoria Jeon

Anbar Azam

MY ROLE

Brand Design: Keeping designs within the Barclays bank brand guidelines.

UX/ UI Design: Wireframing the concept of and with my team, designing additional screens for the Barclays banking app.

User/ Desk Research: I worked together to construct survey questions, conduct in-person interviews and analyzed these resutlts to form insights.

TOOLS

Adobe XD

Figma

OVERVIEW

THE CHALLENGE

Mental health is an issue that affects many people, especially young adults. Money is often associated with the main issue behind mental health. 68% of young adults say that not having full comprehension of all the banking services contribute to money management concerns and stress. Although some use banking apps to try to manage their money, not knowing how to manage their money effectively, young adults indulge in activities that cause them to spend money such as stress shopping and eating, or sometimes leading to mental breakdowns.

THE SOLUTION

Barclays wants to help these young adults be able to manage their money for the future while also teaching them about the banking services that they offer on a platform they are already accustomed to.

WHO IS BARCLAYS?

TARGET AUDIENCE

Barclays has always been at the forefront of banking innovations, from supporting consumers and small businesses to larger businesses and institutions. Barclays is a banking service; while they are aware of the mental health crisis many face, they want to offer their own support through financial solutions.

We are focusing on people who, when dealing with money, maybe an additional trigger for mental health issues. There are a wide variety of mental health issues, from anxiety to stress to addiction. Especially within the Millenial and Gen Z generations, young adults entering the working industry and becoming more aware of their financials, dealing with both stress and banking may lead to further anxiety later on.

Millennials: 25-40 years

Gen Z: 18-24 years

RESEARCH

To be able to understand the connection between banking and mental health in-depth, my team used the Design Thinking Methodology. With the steps from this method, we are able to gather research and create insights out of it to help us get to the best solution.

EMPATHY INTERVIEWS

(including in-person interviews and online surveys)

Do you feel that not having full comprehension of all the bank services/ not being aware contributes to money management concerns?

How do your finances now affect your future plans?

What could your bank do to improve to help you manage your money better?

In what ways do you want to change your spending habits?

How do you deal with the stress when you have issues with money?

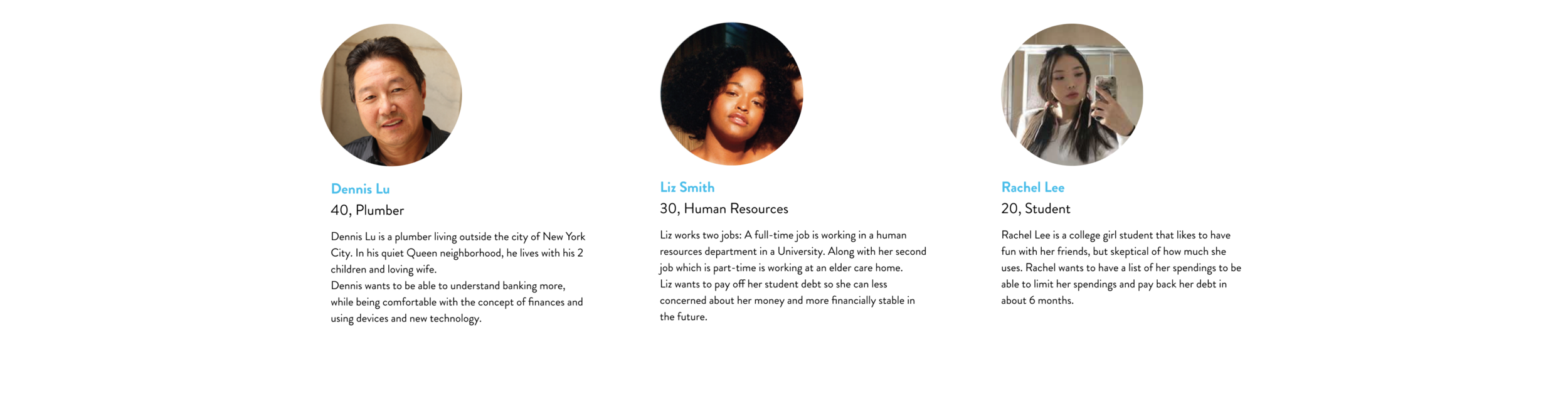

PERSONAS

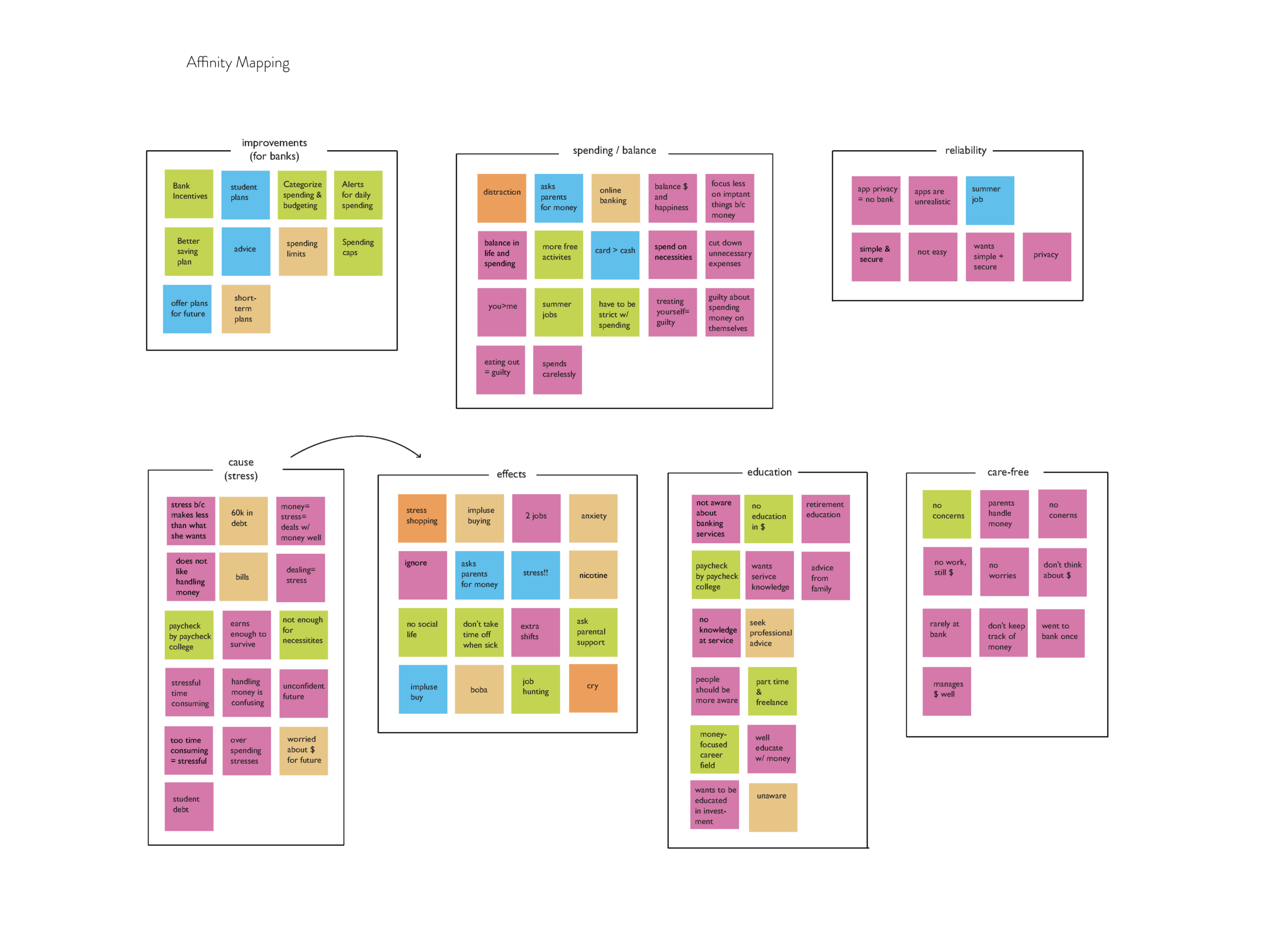

Out of our interviews, surveys, and affinity map, the team created user personas to better connect with the user’s needs.

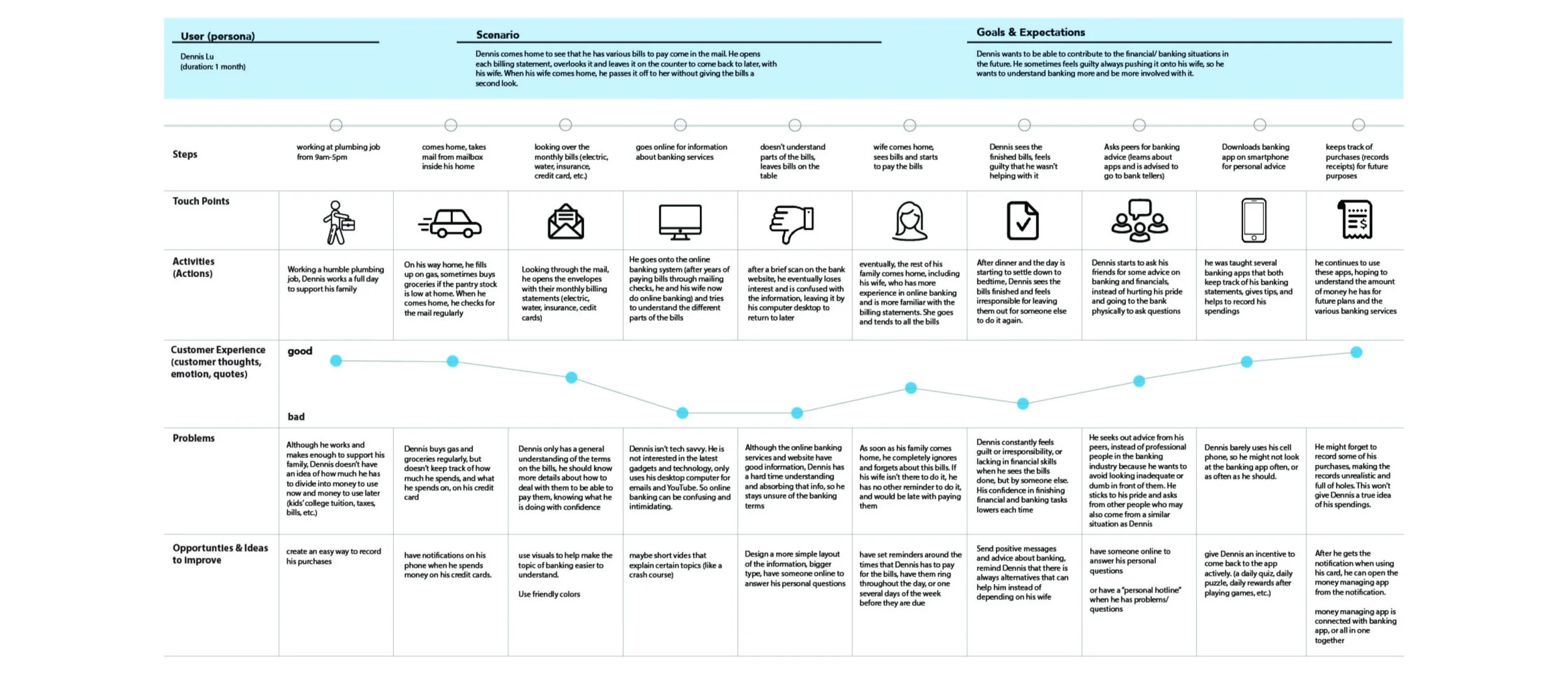

JOURNEY MAPPING

Theme: Money Management & Learning Banking Services

One of the three journey maps created for our personas (Dennis Lu)

HMW

How might we help Dennis be more confident in banking?

Send rewards after each time he finishes taxes

Make a game to learn about the services

Give some kind of incentive to learn and understand

How might we encourage Dennis to use the banking apps?

Create easy to understand designs on apps

Create a positive essence around the concepts of banking

Make the app look more friendly

Maybe have live chats with banking professionals

“How might we help users with mental health issues manage their money better?.”

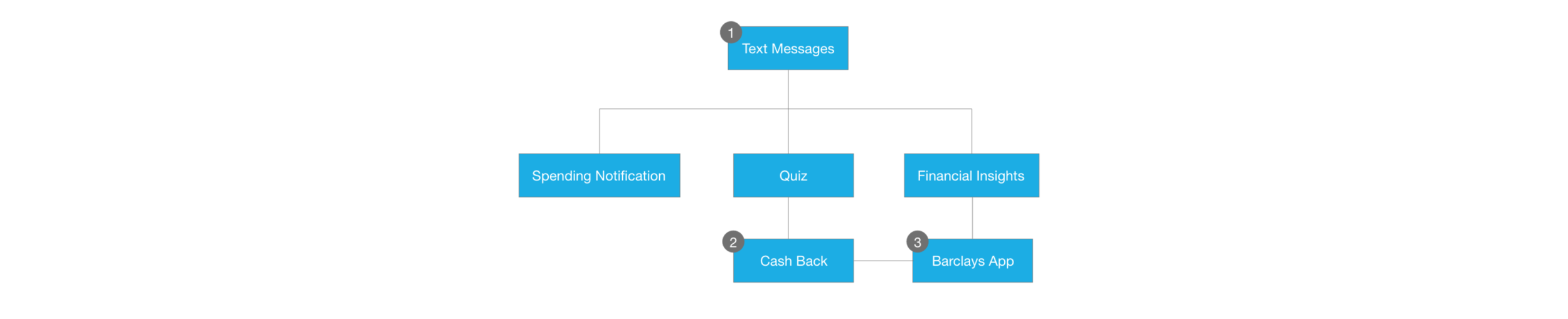

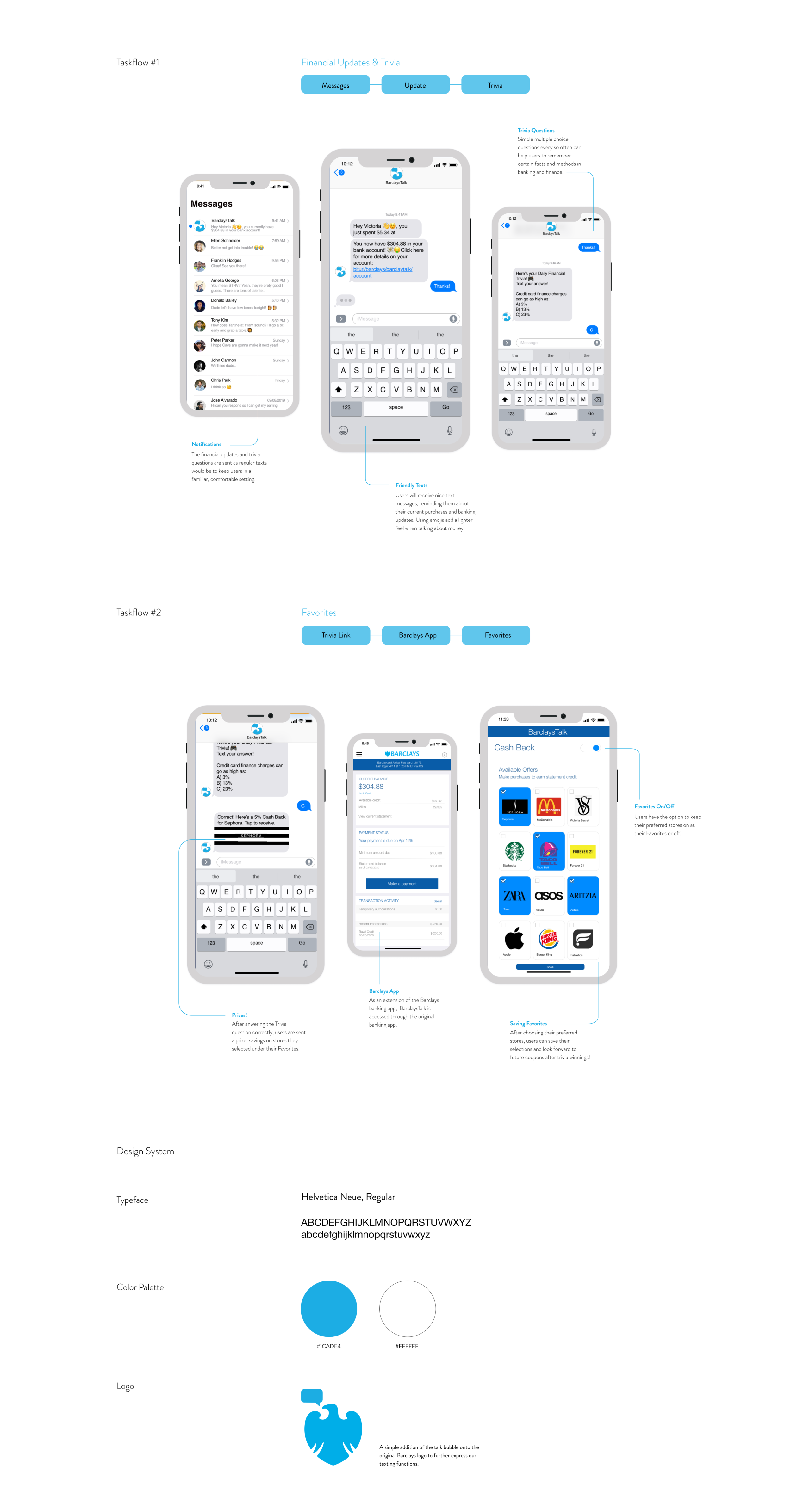

SAMPLE TASKFLOW

Users can receive a text message with their financial update that provides a link to the Barclays app, in the BarclaysTalk extension.

UI DESIGN

As a result of all the insights and research as a collaborative, we found that it was best to offer a way to simplify and summarize banking information. We have a system that sends friendly text messages to the user’s phone after every purchase, to keep track of their finances, while also giving them an update of their accounts. In addition, to give them a fun and interactive way of learning the concepts of banking, there will be a quick trivia! If answered correctly, the user is offered a discount/ promo code to the store listed under their Favorites, which can be set up on the Favorites page in BarclaysTalk.

TAKEAWAYS

RESEARCH GOES A LONG WAY!

By asking the right questions, and follow-up questions in the interviews, I saw how I was able to find out more about the people’s real issues and where they stem from. This really helped me to understand what solutions would be best for them.

LESS IS MORE

During the process of solution brainstorming, my team and I developed many ways to figure out how to bank without triggering any mental health issues. After going through various complicated ideas, we found that it was best to ‘keep it simple’, instead of trying to solve their mental health or banking issues, we’d provide a way to make banking more bearable, with fun little games and casual conversations.